Register in Punjab Old Age Pension Scheme (Senior Citizen)

The state government of Punjab, on continous basis implements beneficial plans for its people. With a goal to provide financial assistant to senior citizens the state government has announced the initiative of a new pension plan termed as Punjab Old Age Pension scheme. Under the new plan, the government of the Punjab state will provide senior citizens with additional pension amount.

- under the leadership of Captain Amarinder Singh led state government, the new scheme was officially launched for the year 2017 – 18 by the Punjab government.

- The Punjab government has also set in motion the pension scheme via its online web portal services for the people of the state, for speeding up the method of launch.

Contents

Key Features

- The individuals of the punjab will be able to take complete profit of the plan both offline and online to get registered under the pension scheme.

- Under the new pension plan, the state government of Punjab would be offering beneficiaries with a pension amount of Rs 500.

- The state government has also made it very pretty clear that the new pension scheme is open for persons belonging to any category or class of the society, irrespective of their sex.

- To get full gain under the new plan online the people of the Punjab state can log on to the official website via http://punjab.gov.in. The application forms could also be filled in online via the same web portal.

Eligibility criteria

- According to documentation, Punjab resident state are only allowed to be registered under the scheme. User has to be citizen of state by birth.

- The beneficiary also has to be 65 years of age (men) and 58 years or age (women) at the time of registration under the scheme.

- The beneficiary at the time of registration must not be employed with any private sector. The plan is only applicable for unemployed citizens.

- The plan is also not valid for any beneficiary who is self employed or having any other source of fixed income that exceeds Rs 60,000 annually.

- Any beneficiary who is holding any commercial property in his name will also not be applicable under the plan.

- In case the beneficiary is owner of a residential property, then to be registered under the scheme she or he must not have residential property over 200 square yards in any urban locality.

- A beneficiary who is a legal taxpayer is also not applicable for getting the profit under the pension paln as per the rules.

Documents required

- At the time of registration, the laabhaartee or we can say beneficiary will have to provide with a copy of their identification proof including Aadhar card, voters name list, certificate issued by hospital for registration, high school certificate, voting card id, Birth certificate etc.

- The beneficiary or laabhaartee will have to submit a copy of valuation of the residential property she or he is holding in their name. The costing has to be done by Patwari.

- Along with the application the user has to submit a self attested letter acknowledging that all information mentioned are true.

- In case the user related to any particular caste or class then she or he may have to given with a copy of their class or caste certificate.

How to get form

To provide the form online user will supposed to go through the official government website Punjab.gov.in from their web browser and then select to fill it offline or online.

How to apply

- In online method, go through the Punjab government website and then select as a new or returning user (in case you have your PW and Login id).

- If you are first time users then you will have to generate PW and ID that can be utilized for logging in to your account from the web portal.

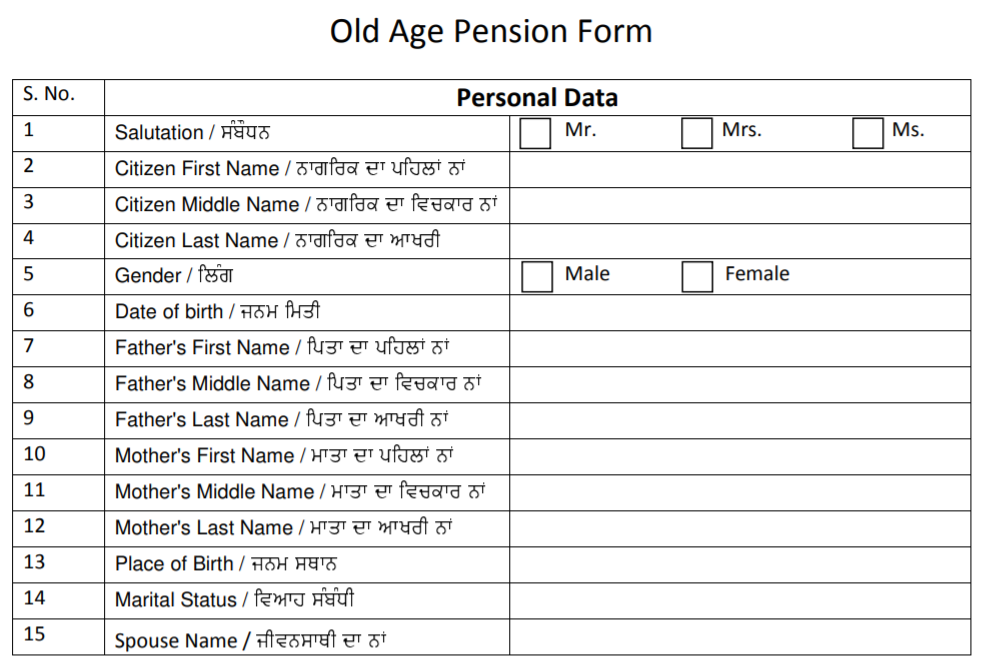

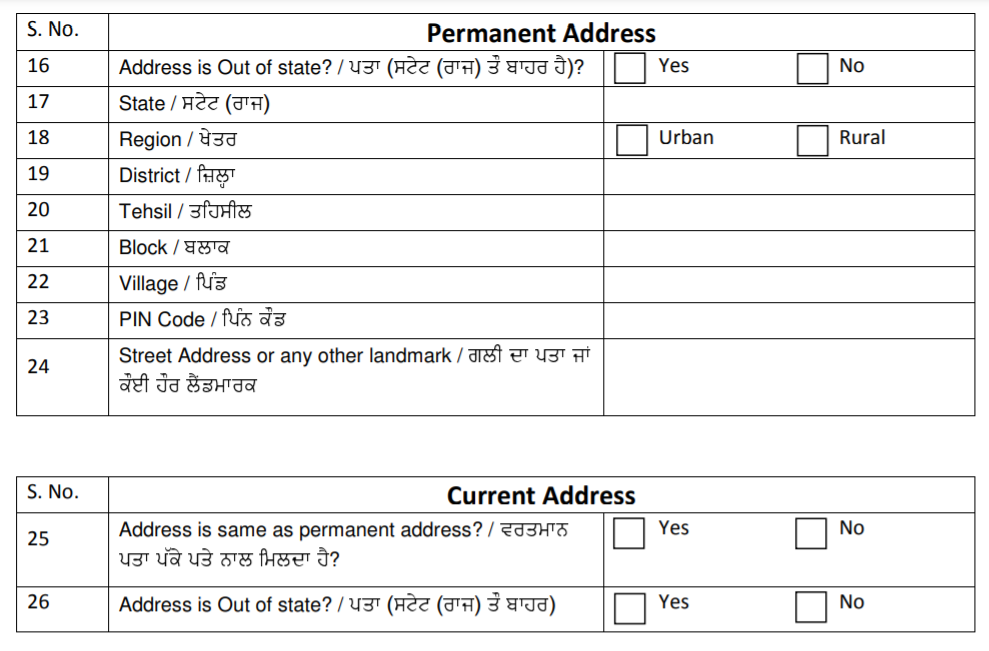

- When generating a profile you have to submit all detailed information for updating your profile. Then you can select online application form for filling in all details.

- Your select has to be made from amongst different services and schemes from the main page. you have to click the “apply” option after selection.

- The selection of application form has to be made from the options offered. You have to complete the form by giving your information details.

- When filling in your details ensure that you ignore making mistakes. Once all details have been given by you then you just have to click the “submit” option.

- You must also save the application form for the future reference so you can verify with its status at any time. You also have to submit all your paper work along with the application form as upload format.

Offline submission

- You can download it and fill in all detail information in offline mode so you may not have to stay linked to the internet when filling.

- Once filled you just suppose to upload the form on the web portal utilizing the upload link provided.

The government of the state needs to provide senior citizens with best profits so they get to enjoy their retirement life cycle with numerous government pension plans.

Whom to contact

Application forms will be obtainable at Sewa Kendra, District Social Security Officer, Department Website, Anganwadi Centre, Child Development Project officer (CDPO), SDM Office, Panchayat & B.D.P.O Office.

Grievances Redressal

- District Social Security Officer

- Head Office, Helpline (0172 2608746)

dsswcd@punjab.gov.in

- Old age pension get bigger to Rs 1500 from Rs 750

- Free travel for women world in government-run buses

- Freedom fighter pension enlarged from Rs 7,500 to Rs 9,500

What is amount of old age pension in Punjab?

Under this parameter, pension is allowed to women of 58 years of age and above and to men of 65 years of age and above. The maximum income of acceptability under the scheme is Rs. 2000/- p.m. for single laabhaartee or you can say beneficiary and Rs. 3000/- p.m. for couple.

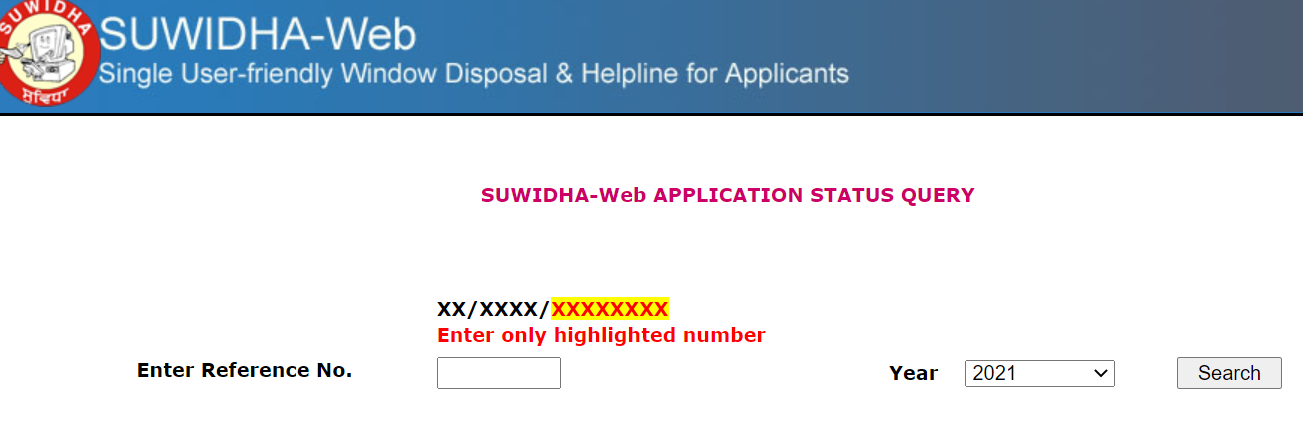

How can I check my old age pension status in Punjab?

- Head Office, Helpline (0172 2608746)

How do I change my old age pension account number?

The initial is the easiest as banks have a designated link bank that processes pensions. Application: To ask for payment to be made at a bank in a different zone or to change the paying bank in the same region, the pensioner supposed to convey a written application, certify by the old bank’s manager, to the new one.

Which bank is best for pension account?

|

Bank |

Account Type |

Interest (in per annum) |

|

ICICI |

Life Plus Senior Citizens Account |

Up to 7.25% |

|

Axis Bank |

Pension Savings Account |

Up to 4% |

|

Bank of Baroda |

Baroda Pensioners Savings Bank Account |

Up to 4% |

|

IDBI Bank |

Pension Saving Account |

Up to 4% |

How can I change my phone number in my pension account?

The personal information such as phone number and email address can now be modified online. To assist the facility, login into your account by utilizing the password and login id given by CRA along with your PRAN Kit.

How do I get a PPO number for my pension?

- Step 1: Log on to www.epfindia.gov.in.

- Step 2: Then click on the Pensioner’s portal.

- Step 3: Next you will be diverted to the ‘Welcome to pensioners portal’. …

- Step 4: In the next one, do enter your PF number or either your bank account number.

Can I get two pensions?

In accordance with sub-rule (11) of rule 54, in case both husband and wife are Government servants and are governed by the provisions of that rule, on their death, the surviving kid is applicable for two family pensions in respect of the expired parents.

Can pension be stopped?

After a pension is permitted or authorized, its continuation depends on future good conduct but it cannot be reduced or stopped for other reasons.

Can pension be recovered?

People taking Old age pension can be recovered including interest if they are giving wrong information.

How many years of service is needed for full pension?

10 years

The minimum eligibility time for receipt of pension is 10 years.

How will I do correction in Atal Pension Yojana?

Go to your NPS account log-in. under main menu “Transaction” Select Tier type, click on sub menu ” Scheme preference Change” and change the Scheme preference as you intended to do.

Why are pensions not credited?

Bank officials do visit the pensioner’s address for issuance of life certificate if the pensioner has a serious illness, failure etc. 3. Over the token submission of life certificates are often lost and hence cause a postpone in getting pension.

Can I deposit cash in pension account?

Yes, just to keep separate history regarding pension, we keep it separate from other saving accounts.

Which government stopped old pension?

NPS initiated with the decision of the Government of India to block defined benefit pensions for all its employees who joined after 1 April 2004.

How do I complain about my pension?

For convenience of pensioner a toll free no. has been there in CPAO which is devoted for getting the grievances of pensioners . All the pensioners can call that number for registration and subsequent follow-up of their disservice.

What job has the best pension?

1. Teaching.

2. Manufacturing and Production.

3. Insurance.

4. Finance.

5. Nursing.

6. Protective Service.

7. State and Local Government.

8. Military.

How long is pension paid after death?

Until the month of the death of the recipient, Pension profits are paid out.

Do pensions count as earned income?

Pension collected by a family person is taxed under the head ‘income from other sources’ in family persons income tax return. If this pension is reduced or is a lump sum payment, it is not taxable. Uncommuted pension received by a family person is free to a some extent.

Is minimum balance required for pension account?

If your bank permits a zero balance then you can withdraw all your cash that you receive as pension in your pension account. If your pension amount is Rs. 15000 and you are needed to keep a minimum balance of Rs. … 14500 from your account.

What jobs still have pensions?

Army, central government servant like air force, navy and state government employees like police.

At what age do seniors stop paying taxes?

The finance minister ordered that old age or senior citizens above the age of 75 years, who only have interest and pension as a source of income will be free from filing the income tax returns. ( said it in the Union Budget 2021)

Is budhapa pension taxable?

Under the head salaries in your income tax return, Pension is taxable. Pensions are paid out systematically, generally every month. However, you may also choose to receive your pension as a commuted pension instead of a periodical payment.