Contents

Some special features of Pradhan Mantri Jan Dhan Yojana

The savings account of the beneficiary is opened under the Pradhan Mantri Jan Dhan scheme.

There is no need to regulate any minimum balance in the account opened under this yojana.

Interest is also given by the bank on the accounts opened under the Pradhan Mantri Jan Dhan scheme.

Under this yojana, a debit card is given to the beneficiary.

Accidental insurance cover of ₹ 200000 is also given under the Pradhan Mantri Jan Dhan scheme. But you can avail this facility only if you have utilized a debit card.

Life insurance cover of ₹ 30000 is also offered under this scheme.

Overdraft facility of ₹ 10000 is also present on Pradhan Mantri Jan Dhan account, but to take benefit of this facility, it is compulsory for the beneficiary’s account to be linked with Aadhaar.

This account is also utilized by the government for direct benefit transfer for any plan.

Benefits of PMJDY 2021

Any citizen of the nation can open his account in banks under this yojana and a small kid up to 10 years can also open an account under this yojana.

Accident insurance up to Rs 1 lakh will also be supported on opening an account under this PMJDY 2021.

life insurance of Rs 30,000 to be paid to the beneficiary on the compensate of usual conditions on his death under the Yojana.

Under PMJDY 2021, interested beneficiaries do take a loan of up to Rs 10,000 without any paper magazine to the account holders on opening a Jan Dhan account in any bank.

Beneficiaries of government yojana will get direct profits in these accounts.

Overdraft facility of Rs.5000/- will be given in one account of each family, especially women account.

(PMJDY) is the National Mission for Financial Inclusion to certain inexpensive access to financial services like Pension, Banking, Credit, Savings/Deposit Accounts, Remittance, Insurance.

The account can be opened at any Business Correspondent or bank branch (Bank Mitra) outlet.

The accounts opened under yojana are being opened with zero balance.

However, if the account holder requires to get the check book, he/she has to fulfill the minimum balance criteria.

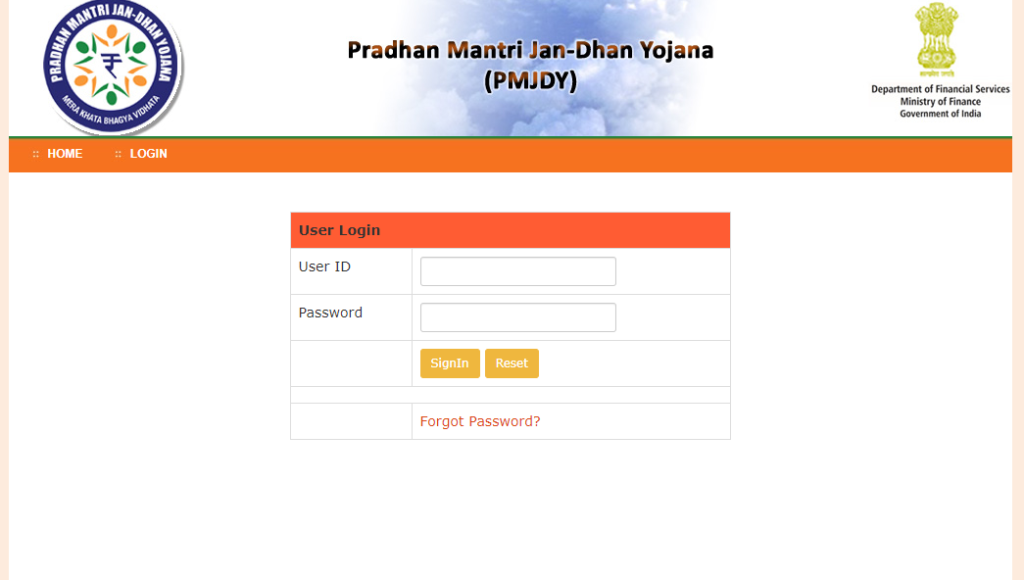

So far 38.22 crore beneficiaries have deposited cash in the banks and so far Rs 117,015.50 crore has been deposited in the bank account of the beneficiaries.

Through the portal

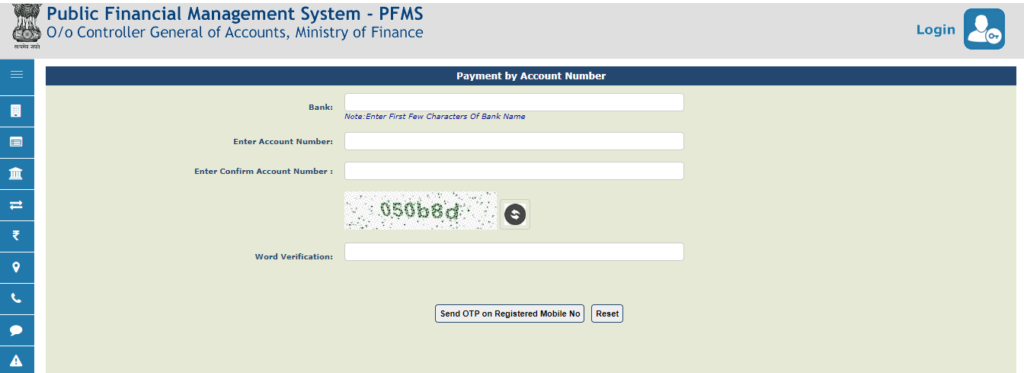

Initially you have to visit the PFMS official website. After go through the official website, the home page will appear in front of you.

On this home page, you will get the option of Know Your Payment. You have to hit on this option. After clicking on the option, the next page will appear in front of you.

On this page you have to enter your account number, your bank name. Here you have to enter twice the account number. Then you supposed to enter the captcha code.

And then you have to hit on Send OTP on Registered Mobile Number. After this OTP will come on your phone number, then you can check your bank balance by entering OTP.

via missed call

If you do not need to check Jan Dhan account balance through the portal, then you can also check your bank balance through missed call.

If your Jan Dhan yojana account is in State Bank of India then you do set out missed call on number 1800112211 or 8004253800.

But you have to make missed call from the same phone number which is registered in your bank account.

bank login process

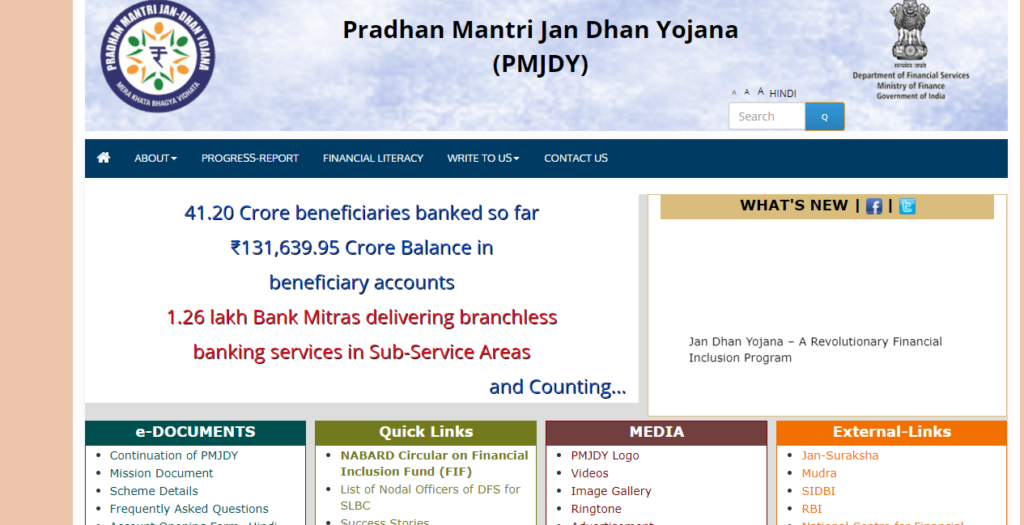

First of all you have to visit official website of Pradhan Mantri Jan Dhan scheme.

- Now the home page will be visible to you

- On the home page, you have to hit on the right to us tab.

- Now you have to hit on the link of bank login.

Now a new page will appear in which you will have to enter password and user-id.

After that you have to hit on the sign in button.

In this manner you do login easily.

Process to download account opening form

First of all you have to visit official website of Jan Dhan scheme.

Now the home page will be visible.

On the home page, you have to visit the section of e-document.

After this, you have to hit on the option of Account Opening Form – Hindi or Account Opening Form – English as per your requirement.

As soon as you hit on this option, the account opening form will be visible.

Now you have to hit on the download option.

In this manner you will be able to download your account opening form.

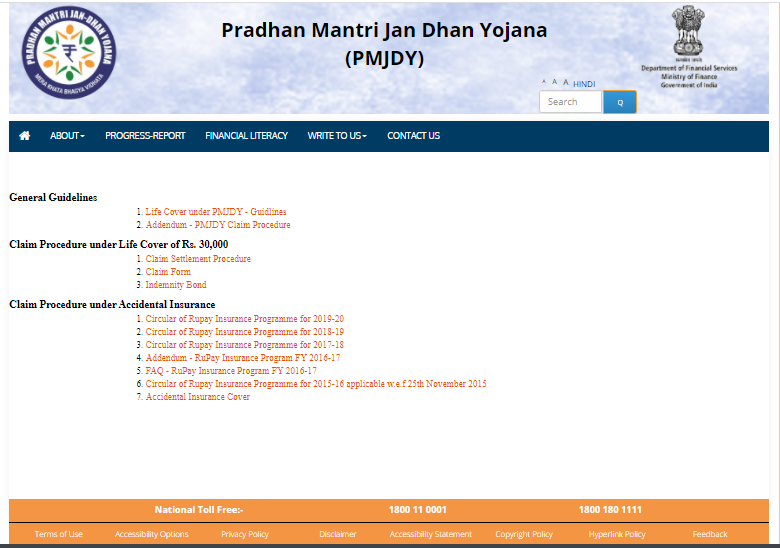

Process to download life cover claim form

First of all you have to visit the official website of Jan Dhan Yojana.

Now the home page will be visible.

On the home page, you have to hit on the option of Insurance cover under scheme.

After that you have to hit on the option of claim form.

As soon as you hit on this option the form will be available.

Now you have to hit on the download option.

This is how you will be able to download the Life Cover Claim Form.

Whether Joint account can be opened in PMJDY?

Yes, joint account can be opened.

Under PMJDY, Whether Cheque Book will be provided in accounts opened?

In the scheme, accounts are being opened with Zero balance. However, if the account-holder desire to get cheque book, she/he will have to fulfill minimum balance criteria, if any, of the bank.

Can a minor (below 18 years of age) open an account under yojana?

A minor of above the age of 10 years can open her / his Savings Bank account in any bank.

Can I get my scheme account transferred to other City / State upon my transfer posting to other States?

All banks participating in scheme are on CBS (Core Banking Solution) platform and the account can easily be transferred to any branch of the bank in any town/city as per the request of the account-holder.