The Reserve Bank of India has made it compulsory for financial institutions, banks and other organisations to verify address and identity of all applicants who carried out financial transactions with them. To do it without much nuisance, KYC method is utilized in. KYC or Know Your Customer is a method through which an institution or bank verifies the address and identity of a person.

Contents

What is KYC?

KYC permit an institution to authenticate the address and identity of a individual. A applicant has to put forward his KYC before he begin investing in different institutions such as bank accounts, mutual funds, and fixed deposits, etc. However, a person has to do it only once when he begin investing for the initial time.

KYC is one such technique which certain that banks are not utilized to carry out money laundering undertaking.

KYC came into extant in 2002 in India and RBI, in 2004, made it compulsory for all banks to carry out KYC of applicants by December 2005.

Why you must do KYC?

When you get your KYC done, you tell the bank about your financial, identity, and address history. This assist banks to certain that the cash invested in it is not for illegal activities and money laundering.

KYC is also compulsory for doing mutual fund investments. However, it is not necessary to carry out the KYC before investing in various fund houses every time.

When is KYC Required?

KYC is necessary before making investments for the foremost time. Some banks also need applicants to file KYC at the time of investing in fixed deposits and opening a bank account.

Types of KYC

There are two types of it:

- Aadhaar-based KYC

- In-Person-Verification (IPV) KYC

Aadhaar-based KYC permits a applicant to perform KYC utilizing his Aadhaar details online. However, he is permitted to invest only up to Rs. 50,000 each financial year per fund.

In case the applicant need to invest more in a specified fund each year, he requires to get In-Person-Verification done. The applicant can either visit a fund house office for in-person verification or authenticate utilizing Aadhaar-biometrics by calling the KYC Registration Agency executive to his office or home.

Some mutual fund houses permit applicant to get their IPV KYC done through video call where they have to show their address proof and original identity. Once finish off, the bar of Rs. 50,000 maximum investment amount is elevated for such applicants.

How to Do KYC?

It can be done in three various manners-

- Online

- Aadhaar-based Biometric Authentication

- Offline

Follow the ways mentioned here to do your KYC online:

Step 1: go through the website of a fund house or and any KRA (KYC Registration Agency)

Step 2: Some of the KRAs are as follows – NSE, CVL , Karvy, CAMS and NDML

Step 3: Enter your info as mention in your Aadhaar card

Step 4: Verify utilizing the C where you suppose to enter the OTP sent to the phone number registered with Aadhaar card.

Step 5: Submit your application

Step 6: Once verify with UIDAI, the KRA accept your KYC

Step 7:You do check the status of your KYC request by going through the portal of the KRA utilizing your PAN

How to Do KYC Online through Aadhaar-based Biometric?

You can get your KYC accepted through Aadhaar-based Biometric authentication. You are permitted to invest only up to Rs. 50,000 p.a. every fund if your KYC is done online. However, if you want your KYC settled through Aadhaar Biometric Authentication, the bar of Rs. 50,000 is raised and there remains no maximum limit of investment.

You have to follow the ways for online KYC utilizing Aadhaar Biometric Authentication

- Go through the portal of fund house or any KRA

- Carry out online KYC as mentioned in the process above

- Appeal for biometric authentication online

- An executive from the fund house call upon the address mentioned in the form

- Show him your real documents and offer your biometrics

- Your application will be send in and KYC will be done

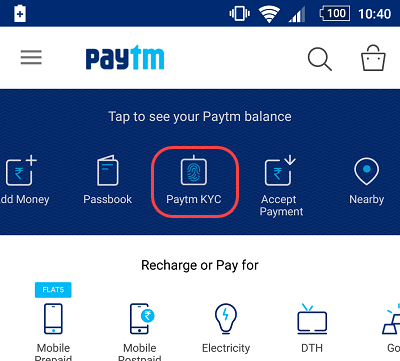

How to complete KYC method through the Paytm app

- Log in to the Paytm App

- Tap on ‘Nearby’ option

- Tap on ‘Upgrade Account’ to proceed

- Select the needed location from the list zones and visit the place to fulfill your KYC

- Applicants will have to carry up their Pan card and Aadhar card as an ID Proof

Major tips from the RBI directions to link Aadhaar to Paytm for KYC completion

- New applicants will have to mandatory offer the necessary KYC details for fulfillment of minimum KYC during the sign-up. For minimum KYC the user are needed to give out their valid ID card info. By completion the minimum KYC requirement the users will be able to utilize their account. However, until the full KYC method is completed, the applicants will not be allowed to keep more than Rs.10,000 in their Paytm wallet and also they will not be qualified to send cash to other bank accounts or wallets.

- The new customers will also have to fulfill the complete KYC procedure and link Aadhaar to Paytm for KYC completion within 12 months of providing the minimum KYC details.

Importance of linking Aadhaar

- The Aadhaar is a compulsory document as per regulations of the Gov.

- Regulations of the RBI Guidelines for any organisation that deals with the money of users

- It is done to eliminate terrorist financing, money laundering, financial fraud and identity theft.

Advantages of linking Aadhaar with Paytm account

- Aadhar linked Paytm customers can flawless way transfer money to bank accounts and other wallets and their wallet limit will raise upto to Rs. 1 lac

- Only such customers do open a savings account with the newly introduced Paytm Payments Bank and earn interest on their savings

- Also, there are numerous exclusive offers as well

Accepted documents: All that is needed is thumb impression of the account holder and Aadhaar card.

Steps to add PAN/Aadhaar Card via App

- Set in motion your Paytm App.

- Hit on the Profile icon at the top right corner of the screen.

- Hit on ‘Edit Profile’ at top right corner of the screen.

- Scroll down to the field for Aadhaar Card and PAN Card.

- Enter your your unique 10-character PAN Card number or 12-digit Aadhaar Card number.

- Your PAN/Aadhaar Card will be connected to your Paytm account within 48 hours post verification.